Claim Support Services

+91-888-666-0856

Claim Support Services

Our Med Policy Coaches provide you free support for all your policy related issues.

We have categorized common issues related to Health Insurance Policy and cliams in six categories. You can view can view suggestions for each step below.

If you are still facing issues, please request a callback.

Choosing Health Insurance Policy

Points to be considered while buying a policy:

Identify the must-haves including

Individual Floater option

Pre and Post Hospitalization cover

List of network hospitals

List of Daycare procedures

OPD Ambulance cover

Maternity cover

Entry and exit Age for Policy

Sum Insured options

Waiting period

Check the premium and cover as per your requirement

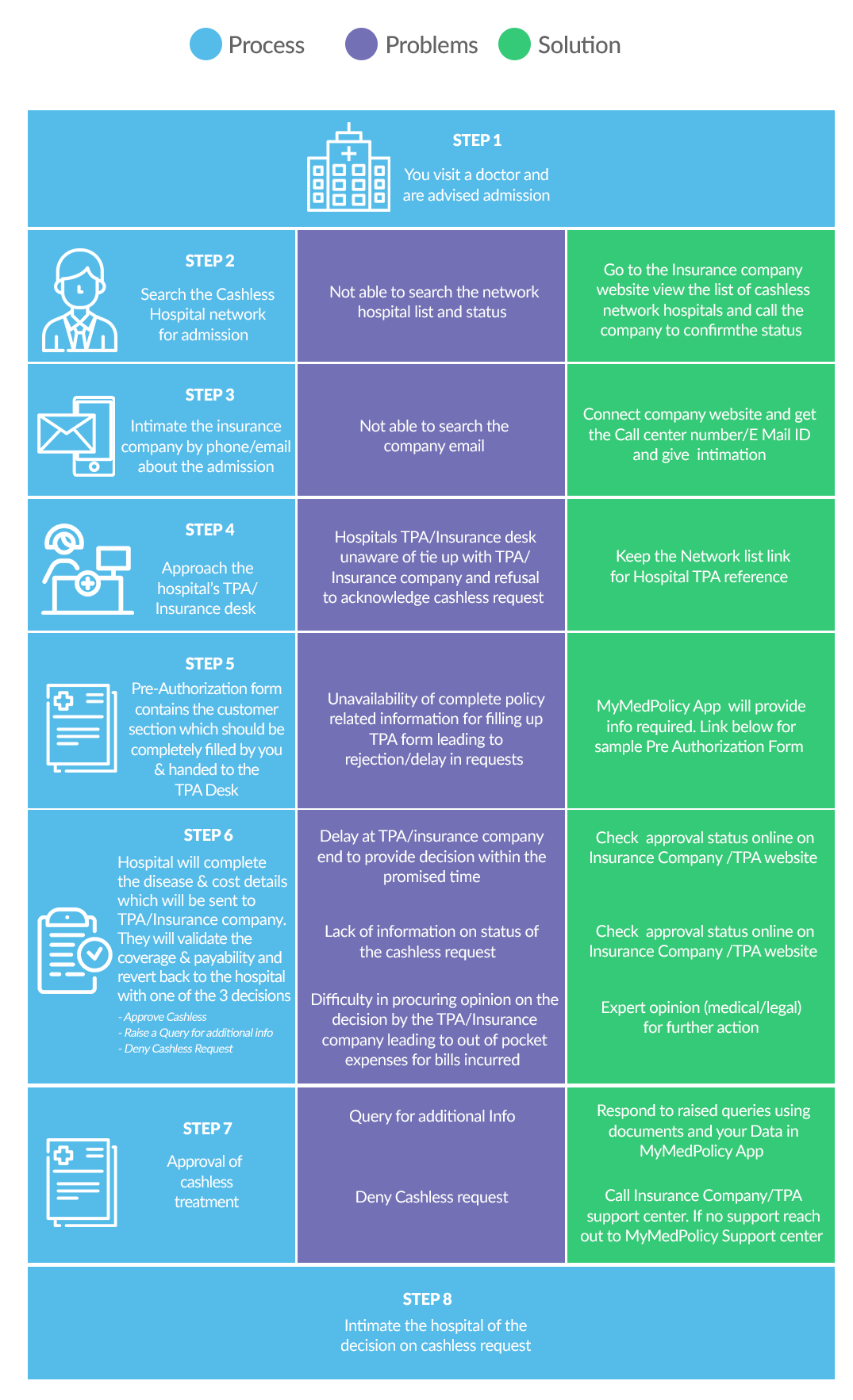

Cashless Hospitalization Process

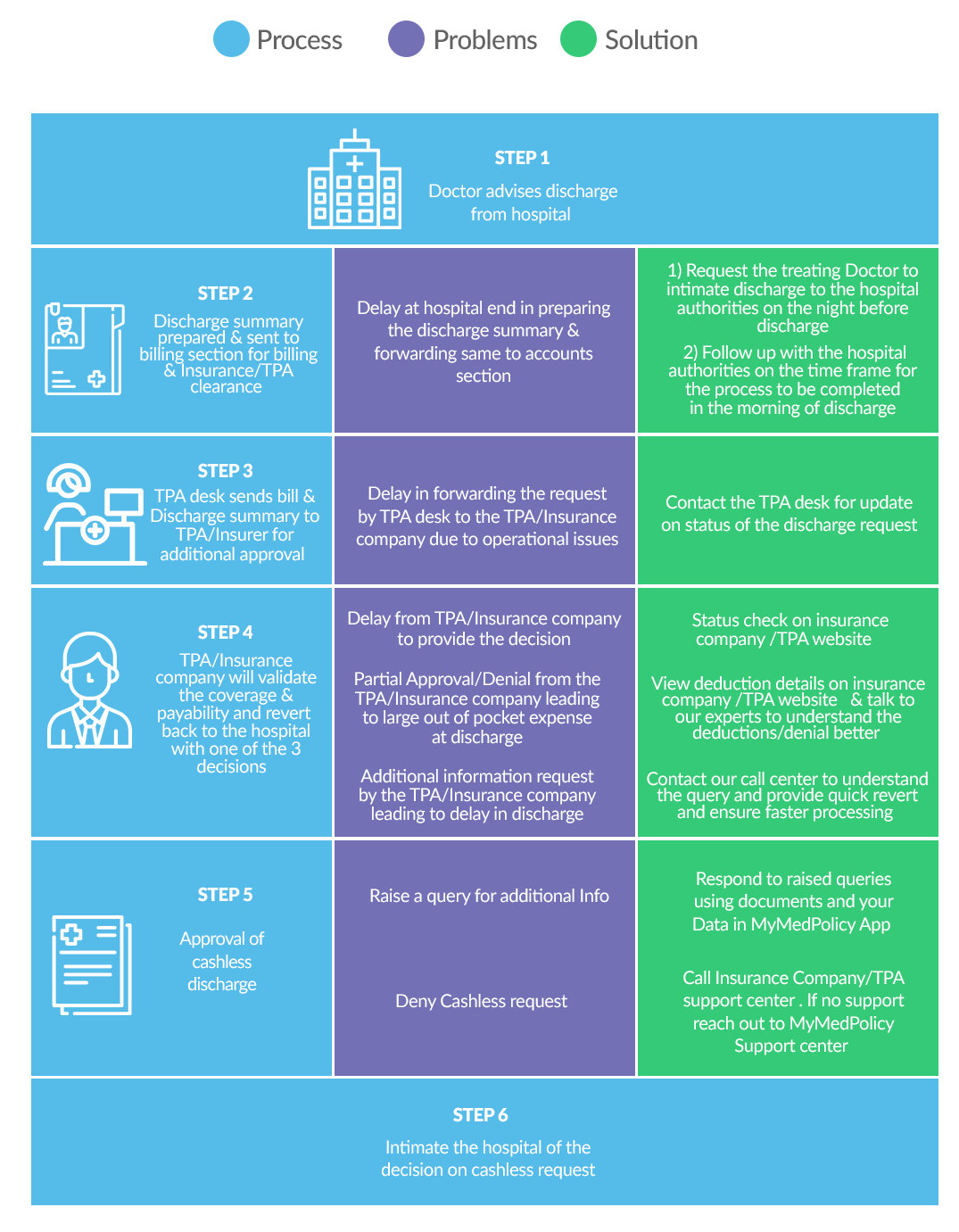

Claim Submission

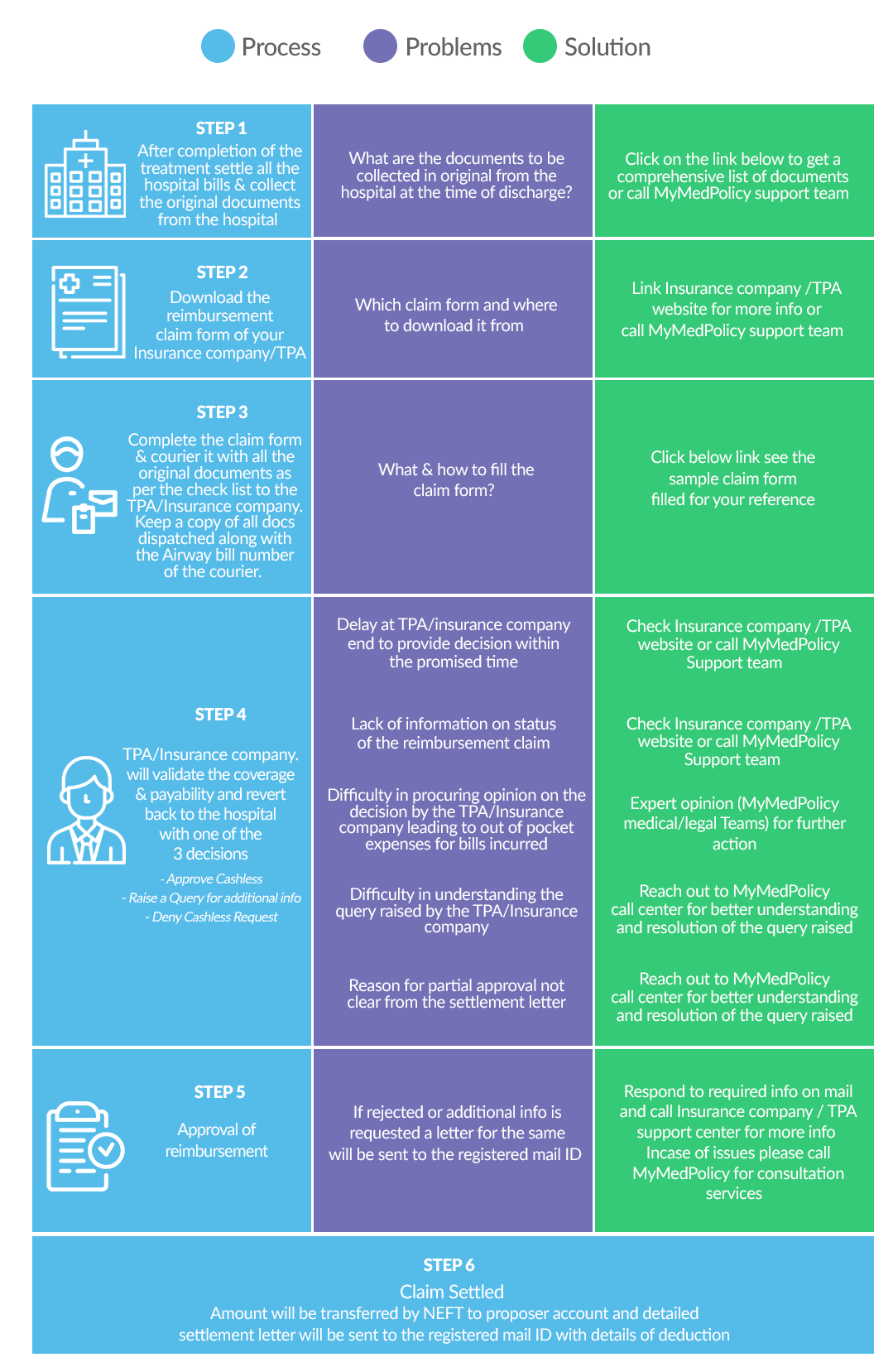

Claim Reimbursement

Claim Settlement Issues

Partial Settlement of claim:

The amount settled by the Insurance company/TPA is lower than the eligible amount and the reasons provided by the TPA/Insurance company is not satisfactory.

Delay in settlement of claim:

IRDA clearly specifies that all claims submitted by the claimant should be settled within a defined time limit, claims may be delayed by the TPA/Insurance company either without any notification or by raising irrelevant queries for additional information/documents.

Rejection of claim:

TPA/Insurance company rejects the claim but the reason provided for the same is not satisfactory

Litigations

How can we Help in Grievance Resolution?

We offer the following services which can guide/help you in grievance resolution:

1. Expert opinion by Industry experts: Our Insurance experts can help you understand the grievance better by providing reasons for the deductions/queries/rejections thus helping in resolution of the same, they can also provide you with guidance of how and who to approach for resolution of the grievance

2. Expert Medical Opinion: Our panel of specialist doctors can provide expert second opinions which can be used to counter the arguments by the Insurance company to delay/reject the claim. These opinions can also be used in the Ombudsman/Legal hearings.

3. Expert Legal opinions: Our team of legal experts can provide opinion on how & where to file your case and also help with legal documentation/representation if desired.

4. Ombudsman: Our App/website provides the details of all the Ombudsman office in the country. You just need to provide the claim location on the same and the address/communication details of the same will be immediately available.